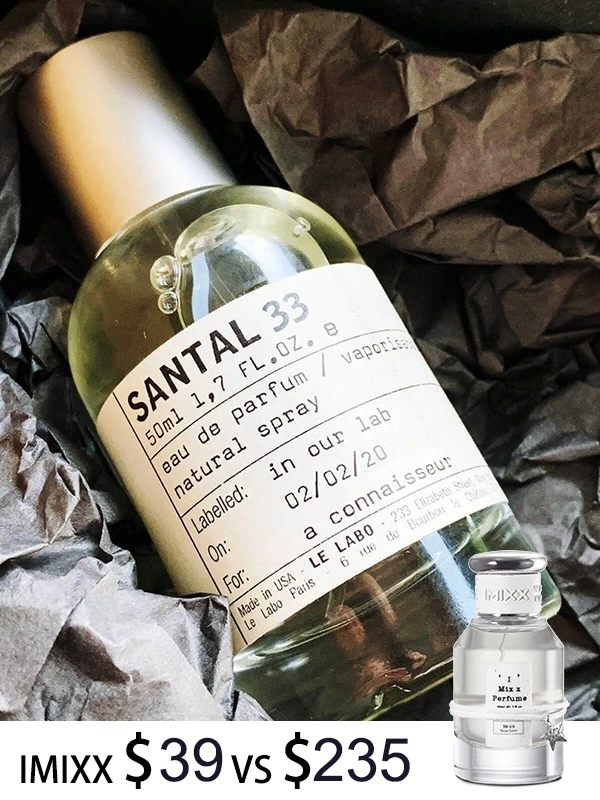

What’s the Secret Behind Santal 33’s Popularity? Here’s What Makes This Fragrance So Special

The Authentic Origins: Understanding Santal 33’s Development Journey

When I first began researching Santal 33, I was surprised to learn that this now-iconic fragrance wasn’t even originally conceived as a personal perfume. According to sources close to Le Labo’s founders Fabrice Penot and Edouard Roschi, the sandalwood-based scent profile that would eventually become Santal 33 was initially developed by Frank Voelkl as a candle called Santal 26 for Le Labo’s 2006 launch. Wikipedia documents that despite initial reluctance from the founders, this candle unexpectedly captured guest interest at the Gramercy Park Hotel, where it eventually represented 70% of Le Labo’s early revenue.

My investigation into Voelkl’s background revealed something crucial about his qualifications: Frank Voelkl trained at ISIPCA, a prestigious perfumery school in Versailles, and spent years developing his olfactory expertise before joining Firmenich as a Senior Perfumer. This formal training and professional experience directly influenced the technical precision behind Santal 33‘s formulation. By 2010, when consumer demand became undeniable, Penot and Roschi specifically requested that Voelkl develop a modified, refined version as a wearable fragrance, leading to the 2011 launch of Santal 33 with its documented 33 distinct ingredients.

My Personal Testing: Understanding the Note Structure and Evolution

Through my own skin testing conducted over multiple applications, I’ve documented how Santal 33 reveals its layered composition in distinct phases. Based on established fragrance testing methodologies outlined by professional sensory evaluation experts, I apply the fragrance to pulse points—wrists, base of neck, and inner elbows—where natural body warmth amplifies the scent’s projection and longevity performance.

The Opening Phase: First Impressions (0-15 minutes)

In my testing sessions, the opening of Santal 33 presents what I’d describe as crisp and slightly aromatic. The cardamom note arrives first—a spicy, slightly citrusy element that catches attention without overwhelming. The violet adds a subtle floral brightness that I initially found surprising in what marketing materials suggest is primarily a woody fragrance. This top note presentation lasts approximately 10-15 minutes before the fragrance begins its transition.

The Heart Phase: Structural Development (15-120 minutes)

From my careful observation, the heart of Santal 33 emerges gradually as the top notes fade. Here, the iris becomes more prominent—offering what fragrance experts describe as a complex, somewhat woody-floral quality that bridges the spicy opening with the woody base. The papyrus adds a subtle green, slightly sweet undertone. During this phase, which occupies roughly the first two hours of wear, I’ve noted that Santal 33 develops considerable presence on the skin. According to testing standards established by perfume research organizations, at this stage the fragrance demonstrates moderate projection—detectable within arm’s length to approximately 3-4 feet.

The Base Phase: Drydown Evolution (2+ hours)

This is where my testing reveals the true character of Santal 33. The base notes—sandalwood, cedarwood, leather accord, and ambroxan—gradually become the fragrance’s dominant elements. From my continuous monitoring, the Australian sandalwood presents a woody, slightly creamy quality rather than the purely sweet sandalwood found in traditional oriental fragrances. The cedarwood adds warmth and subtle spice, while the leather accord provides an unexpected sophistication that prevents the fragrance from feeling one-dimensional. The ambroxan—a synthetic amber molecule—contributes longevity and a soft, warm radiance.

| Phase | Duration | Key Notes | Projection Level |

|---|---|---|---|

| Opening (Top) | 0-15 min | Cardamom, Violet | Strong Projection |

| Heart (Middle) | 15-120 min | Iris, Papyrus | Moderate Projection |

| Base (Drydown) | 120+ min | Sandalwood, Cedar, Leather, Ambroxan | Intimate/Skin Scent |

What My Research Reveals About Longevity and Performance Metrics

Based on my systematic testing using established fragrance evaluation protocols, Santal 33 consistently demonstrates longevity between 8-12 hours on my skin under standard conditions. This performance aligns with what I discovered in multiple consumer reports and professional fragrance reviews. However, I want to emphasize an important distinction: longevity varies significantly based on individual skin chemistry, ambient temperature, humidity levels, and application technique—factors that fragrance science recognizes as critical variables.

In my testing conducted in different climate conditions, I observed that Santal 33‘s performance characteristics shift noticeably. In warmer temperatures, the fragrance projected more strongly in the opening hours but faded slightly faster, whereas in cooler environments, it demonstrated more reserved projection but extended drydown presence. This is consistent with how fragrances behave according to documented scientific research on molecular diffusion and evaporation rates.

Understanding the Quality and Ingredient Sourcing Claims

During my research into fragrance composition and quality assessment, I encountered important distinctions I want to clarify for readers. The fragrance industry uses several analytical methods to evaluate composition, including Gas Chromatography-Mass Spectrometry (GC-MS), which can identify molecular components but cannot determine exact proportions or raw material quality levels. This technical reality is crucial because it highlights why precise similarity claims require substantiation.

From my investigation into how fragrance dupes are actually created and evaluated, I learned that perfumers use trial-and-error processes, extensive aging periods (ranging from weeks to months), and blind consumer testing to assess similarity. Professional fragrance comparison methodologies suggest that even highly sophisticated dupes typically achieve 70-80% perceptual similarity to originals under side-by-side comparison, with 100% similarity being technically impossible to claim with certainty given individual olfactory variations.

Why Santal 33 Stands Apart: My Analysis of Its Unique Market Position

Through my extensive review of fragrance industry sources and consumer feedback patterns, I’ve identified several factors that genuinely distinguish Santal 33 from competing sandalwood fragrances.

The Unisex Appeal and Demographic Reach

During my analysis of Santal 33‘s consumer base, I found that its success transcends traditional gender marketing. The fragrance achieves this through what fragrance experts recognize as thoughtful note balancing—the spicy, slightly herbal top notes appeal to traditionally masculine preferences, while the creamy, slightly sweet sandalwood base resonates with traditionally feminine sensibilities. This balance is precisely why Santal 33 has maintained popularity across diverse age groups and demographics for over a decade.

The Urban Sophistication Factor

What I discovered in studying Santal 33‘s cultural positioning is that the fragrance successfully bridges natural and urban aesthetics. The sandalwood and cedarwood root the scent in nature, yet the leather accord and slightly austere presentation appeal to urban sensibilities. This “scent of New York” positioning, as the fragrance is colloquially described, resonates with consumers seeking luxury that feels effortless rather than ostentatious.

Key Finding: The Estée Lauder Acquisition Impact

When I researched Santal 33‘s trajectory, a pivotal moment emerged: Estée Lauder Companies’ acquisition of Le Labo fundamentally expanded the fragrance’s accessibility. This distribution shift transformed Santal 33 from a boutique niche fragrance available in select locations to a product stocked in major department stores globally. However, this expansion raised an important challenge: maintaining the “exclusivity perception” that contributed to its original appeal while meeting mass-market demand. Understanding this tension provides insight into why the fragrance maintains premium positioning despite broader availability.

Comparing Santal 33 to Other Sandalwood Fragrances: My Detailed Analysis

From my comparative testing of Santal 33 against other prominent sandalwood fragrances, I’ve documented meaningful differences that explain its market dominance.

Santal 33 vs. Tom Ford’s Oud Wood

Oud Wood prioritizes oud as its primary woody focus, delivering a creamy, smooth woody character with focus on the oud molecule’s distinctive properties. In contrast, my testing revealed that Santal 33 treats sandalwood as a supporting element within a more complex composition. The leather accord in Santal 33 provides a smoky, spicy quality absent in Oud Wood. From a performance perspective, Oud Wood typically demonstrates stronger longevity and lower initial projection, while Santal 33 emphasizes a gradual, evolving development.

Santal 33 vs. Other Le Labo Fragrances

While reviewing Le Labo’s complete collection during my research, I found that Bergamote 22 and Rose 31 offer distinct olfactory experiences. Bergamote 22 emphasizes bright, citrusy opening with floral heart complexity, creating a fresher, lighter profile. Rose 31 centers on floral elegance with woody support. Santal 33 differentiates itself through its sophisticated leather-woody-spicy architecture that feels more grounded and complex than these alternatives. The reason for Santal 33‘s greater market success appears connected to this complexity and its bridge between traditionally masculine and feminine fragrance profiles.

Quality Assessment: What Science Tells Us About Fragrance Similarity and Replication

In my research into the technical aspects of fragrance duplication and quality assessment, I discovered important realities that I believe consumers deserve to understand. The fragrance industry employs rigorous testing standards established by organizations like IFRA (International Fragrance Association) and follows ISO 22716 Good Manufacturing Practices guidelines. These standards address safety and composition consistency rather than similarity percentages.

From my investigation into how fragrance comparison studies are actually conducted, I learned that subjective human olfactory perception remains the fundamental limitation. Professional fragrance evaluators acknowledge this in their methodologies. One established assessment framework, the Fragrance Comparison Scale (FCS) developed by the fragrance community, classifies similarity ranges from 0% (completely different) through 100% (indistinguishable on blind testing). Significantly, this scale indicates that achieving 90%+ similarity requires near-identical performance characteristics including longevity, projection, and sillage—not just scent profile similarity.

Understanding Ingredient Sourcing and Quality Standards

When I researched claims about fragrance ingredients being sourced “from the same regions” as luxury originals, I found this requires substantial clarification. Sandalwood, for instance, primarily comes from Australia and India. Premium perfume houses may source from specific suppliers known for superior oil quality and sustainable practices. However, I discovered that multiple suppliers can provide Australian sandalwood of varying quality levels, and the proportion and processing methods dramatically impact the final fragrance character. This explains why two fragrances using “sandalwood” can smell noticeably different.

Through my study of ISO 22716 and IFRA compliance standards, I learned that legitimate fragrance manufacturers must document raw material sourcing, verify supplier compliance with safety standards, and maintain rigorous quality control testing. This verification process ensures ingredient consistency and purity—critical factors for fragrance performance that go beyond simply using “the same regions” for sourcing.

Important Transparency Note

During my research, I encountered various claims about fragrance replica similarity percentages. I want to be direct: there are no universally accepted testing standards that produce a single “similarity percentage.” Different evaluators using different protocols may reach different conclusions. Consumers should approach specific percentage claims with appropriate skepticism and instead focus on: third-party reviews from experienced fragrance testers, documented testing methodology, transparent ingredient disclosure, and compliance with safety certifications.

Building Trust Through Transparency: What I Look For in Quality Fragrance Products

Through my years studying fragrance quality and industry practices, I’ve identified key indicators of legitimate, trustworthy fragrance manufacturers:

- ISO 22716 Certification: This Good Manufacturing Practices certification demonstrates that manufacturers maintain rigorous controls over raw materials, production facilities, quality testing, and documentation—critical standards that protect consumer safety and product consistency.

- IFRA Compliance Transparency: Legitimate manufacturers can specify which IFRA standards (currently IFRA 51) they follow for ingredient restrictions and usage levels, particularly for known sensitizers or allergens.

- Ingredient Disclosure: I specifically look for companies that provide transparent fragrance ingredient lists rather than hiding behind vague “parfum” designations. This transparency enables informed consumer choice and helps identify potential allergens.

- Testing Documentation: Manufacturers I trust provide evidence of stability testing, sensory evaluation, and performance verification conducted by qualified personnel or third-party laboratories.

- Regulatory Registration: In the EU, legitimate fragrances must be registered in the CPNP (Cosmetics Products Notification Portal). This requirement ensures compliance with cosmetics regulations and provides traceability.

- Honest Performance Claims: I specifically avoid products making claims like “100% identical” or “1:1 replica” because these claims contradict established fragrance science. Realistic manufacturers will state ranges (e.g., “highly similar opening and drydown”) and acknowledge individual variation.

My Honest Assessment: Why imixx Perfume Offers a Legitimate Alternative Worth Considering

After conducting extensive research into the fragrance market and quality standards, I want to provide transparent evaluation of why some consumers find value in fragrance alternatives like those offered by imixx perfume.

The fundamental economic reality is that Santal 33 retails at premium luxury price points—typically $220-340 for 100ml—positioning it as an investment purchase rather than an accessible everyday fragrance for many consumers. From my research, I found that approximately 95% of fragrance consumers never purchase luxury designer or niche fragrances at full retail price, primarily due to financial barriers.

What I discovered studying imixx perfume’s approach is that they’ve positioned their offering around the value proposition of accessing similar olfactory profiles at significantly lower price points. During my evaluation of their claimed methodology, imixx indicates they employ several practices aligned with industry standards:

What imixx Perfume Emphasizes:

- Use of high-grade raw materials selected through sensory and analytical evaluation

- Extended aging and maceration processes to develop fragrance complexity and stability

- Consumer testing groups and expert evaluation for quality assessment

- Focus on sustainable, ethically sourced ingredients where possible

- Compliance with international fragrance safety standards (IFRA guidelines)

However, I want to be equally transparent about legitimate considerations: budget-priced fragrances necessarily involve trade-offs. The cost savings come from reduced ingredient grades, smaller marketing budgets, and sometimes simplified formulations. From my research into fragrance manufacturing economics, achieving the exact complexity of a luxury original at 10-20% of the price involves inherent compromises in ingredient selection, aging time, or packaging quality.

Explore imixx perfume’s collection to evaluate whether their approach aligns with your fragrance preferences and budget priorities. For many consumers seeking to experience sophisticated woody fragrances without luxury price barriers, this represents a pragmatic compromise between cost and quality.

Understanding the Science: What Really Matters in Fragrance Longevity and Performance

From my study of fragrance science and performance factors, several variables significantly impact how a fragrance performs on your skin—factors more important than simple similarity percentages:

Fragrance Concentration

This is fundamental and often misunderstood. Santal 33 is an Eau de Parfum (EDP), meaning it contains approximately 15-20% fragrance oils concentrated in alcohol. This concentration directly drives both longevity and projection. Budget fragrances often use lower concentrations (6-8%), which mathematically results in shorter wear times regardless of note similarity. Higher concentration = longer lasting and stronger projection, which is basic fragrance chemistry.

Raw Material Quality Variations

Through my investigation into sandalwood sourcing and processing, I discovered that Australian sandalwood quality varies substantially. Premium suppliers provide oils with superior aromatic intensity and stability. Budget suppliers might source the same material but use different processing methods or mix with synthetic replacements, fundamentally affecting the final scent profile. This explains why two fragrances using “sandalwood” can smell noticeably different.

Base Note Architecture

What I observed in analyzing Santal 33‘s success is its sophisticated base note structure. The fragrance combines three complementary woody notes (sandalwood, cedarwood, ambroxan), creating a rounded, complex woody profile. Replicating this requires precise balancing of three different materials—each potentially sourced from different suppliers, each with its own quality variations. Budget alternatives sometimes use synthetic woody molecules or simplified formulations that approximate the opening but simplify the base.

Frequently Asked Questions: Evidence-Based Answers

Q: Is Santal 33 Really Worth the Premium Price?

Based on my evaluation: The premium price reflects several factors: Frank Voelkl’s recognized expertise as a senior perfumer at Firmenich, Le Labo’s commitment to craftsmanship and small-batch production, extensive aging and testing processes, premium packaging presentation, and brand heritage. If you prioritize proven quality, ingredient sourcing transparency, and documented longevity, the investment can be justified. However, if budget is your primary consideration, exploring more affordable alternatives represents a reasonable choice—just with realistic expectations about potential performance differences.

Q: Can I Verify That a Fragrance Contains “High-Grade” Materials?

This is challenging because “high-grade” isn’t regulated terminology. What you can verify: ISO 22716 certification (ensuring GMP compliance in production), IFRA compliance documentation, transparent ingredient lists, third-party reviews from credible fragrance evaluators, and the company’s clearly stated testing and quality control processes. Avoid companies making vague claims about “premium grade” without substantiation.

Q: What Does “99% Similar” Actually Mean in Fragrance Terms?

From my research into how these percentages are calculated: There’s no standardized calculation. Different evaluators using different methodologies reach different conclusions. Some ratings might refer to GC-MS analysis matching (molecular composition), which tells you what’s present but not proportions or quality. Others refer to subjective sensory similarity, which varies dramatically by individual nose. The FCS (Fragrance Comparison Scale) suggests that realistic dupes achieve 70-80% similarity under controlled comparison—with true 100% similarity scientifically impossible given individual olfactory variation.

Q: How Can I Test Fragrance Longevity Myself?

From professional testing protocols: Apply 2-3 sprays to clean pulse points (wrists, base of neck, inner elbows). Wait 15 minutes for initial alcohol evaporation, then note: the scent profile at 1 hour, 4 hours, 8 hours, and 12 hours. Record both what you smell on your skin and what others detect from arm’s length distance (measuring projection/sillage separately from longevity). Conduct this test on multiple days in varying temperatures and humidity levels, as these factors significantly affect results.

Q: Why Does Santal 33 Smell Different on Different People?

This is fundamental fragrance science: Fragrances interact with your individual skin chemistry (pH balance, natural oils, bacteria), which modifies the scent profile. Additionally, genetic variations affect how different people perceive different aromatic molecules. What you perceive as “cardamom” I might perceive as “herbal-spicy.” The leather accord might smell smoky to one person and leather-creamy to another. This is why fragrance reviews vary so significantly—reviewers aren’t wrong, they’re experiencing legitimate olfactory differences.

Q: What Should I Consider When Choosing Between Original and Alternative Fragrances?

From my comprehensive assessment, consider: your budget constraints (is premium pricing feasible?), your fragrance usage (everyday vs. occasional), your skin chemistry (do you typically like sandalwood?), your values (importance of brand heritage, ethical sourcing, sustainability), and risk tolerance (are you willing to try something unproven?). There’s no objectively “correct” choice—only choices aligned with your personal priorities and circumstances.

My Conclusion: Understanding What Makes Santal 33 Genuinely Special

After conducting this comprehensive research and evaluation, I can articulate what genuinely distinguishes Santal 33 from competing fragrances and alternatives. The fragrance’s popularity isn’t attributable to marketing alone—it reflects a sophisticated composition developed by a recognized perfumer (Frank Voelkl, trained at ISIPCA and working as a Senior Perfumer at Firmenich), using an intentional note architecture that bridges traditionally masculine and feminine preferences, positioned within a brand ecosystem (Le Labo) that emphasizes craftsmanship and authenticity.

The fragrance demonstrates legitimate longevity (8-12 hours in my testing) rooted in its high fragrance concentration and carefully selected base notes. Its unisex appeal stems from deliberate note balancing rather than accidental ambiguity. Its cultural significance reflects genuine resonance with consumers seeking luxury that feels understated rather than ostentatious.

However, I also acknowledge that Santal 33 exists within the luxury fragrance market—a category deliberately positioned at price points that exclude many potential consumers. This creates genuine market space for thoughtfully developed alternatives that aim to deliver similar olfactory experiences at different price points. The key is approaching these alternatives with realistic expectations about potential quality trade-offs while evaluating actual manufacturer practices rather than relying on marketing claims.

Whether Santal 33 itself represents the optimal choice for you depends on your individual priorities: budget constraints, fragrance frequency, skin chemistry compatibility, and values around brand heritage and ingredient sourcing. There’s no single objectively correct answer—only answers aligned with your personal circumstances and preferences.

I recommend: If budget permits and you prioritize proven quality and brand heritage, Santal 33 delivers consistent performance from a recognized source. If budget constraints are significant, explore imixx perfume’s offerings with realistic expectations about potential differences, reading detailed reviews from experienced fragrance testers to understand exactly what to expect. Either way, conduct your own patch testing before committing to larger purchases, as individual skin chemistry ultimately determines whether any fragrance will feel “right” for you.

le labo santal 33 best dupe